High Inflation and Increasing Interest Rates

High Level View

Much has changed in the first six months of the year with the good returns from markets in 2021 all-but-forgotten as the war in Ukraine rages on and central banks across the globe raise interest rates in an attempt to contain high inflation.

The following factors have all contributed to a rise in prices of everything from food to petrol and even rent:

- the unwinding of COVID-related restrictions,

- increased demand for goods from consumers,

- supply chain disruptions,

- US wage increases, and

- high oil and energy prices due to the Eastern European conflict.

This has led to a rise in prices of everything from food to petrol and even rent. At the beginning of the year, expectations for global economic growth were positive as countries recovered from the COVID-related downturn but this has now turned sharply negative as central banks raise interest rates aggressively to cool their economies and keep prices from rising further.

As a result, equity and bonds markets reacted negatively which left little place for investors to hide. This is also reflected in the most recent returns of the various NFMW investment portfolios

However, we feel that most of the bad news has now been priced into the market and it is likely that the market will enter a recovery phase within the next six to twelve months. However, members should expect high volatility in returns until the effects of high inflation have passed and there is some resolution to the war in Ukraine.

More Detailed Commentary

As noted above, equity markets reacted to central bankers’ more aggressive stance on inflation by falling the most on record in the first half of this year. Global markets fell by 20% in dollar terms while the local equity market fell just by 5% in rand terms in the first six months of 2022, as investors took into account higher interest rates and the increased probability of a recession in the US.

The local equity market fared better than its global counterparts, supported by higher commodity prices (until recently) and as share prices for many non-commodity local companies lagged global counterparts through much of the previous year. With less “hot air” in the price, a smaller “deflation” was needed to bring share prices in line with the new expectations.

Local bond yield followed global yields higher. The difference is that South Africa’s bond yields were already high (close to 10%) so the move to 10.5% was not as severe as for the US which saw yields rise from 2% to 3.5% in the first six months of the year, resulting in severe capital losses. Local bond investors also suffered losses, but these were offset by the higher income yield.

With inflation in South Africa rising to 6.5% in May, the South African Reserve Bank was forced to raise interest rates and will likely continue to do so until it is evident that prices are normalising. The Monetary Policy Committee has a difficult job to do, as much of our local inflation is driven not by increased demand (as in the US) but by a combination of higher oil prices and a weaker rand. The rising price of petrol feeds into prices of everyday goods and services as transport costs rise. Similarly, higher commodity prices feed into the prices of fertiliser (food inflation) as well as input costs for all manufactured goods.

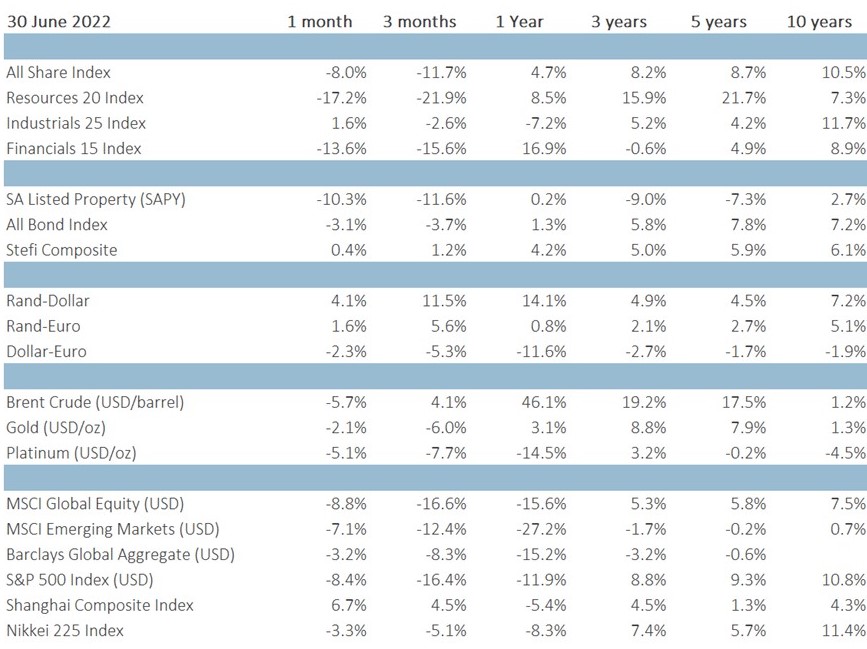

Market Returns Over Various Periods

The table below shows different market returns over various periods to give members a better understanding of how markets performed over the longer and shorter term. It is important to note the vast differences in returns between asset classes, currencies, commodities and market sectors, which means that there is still some value to be found in parts of the investment universe.

Weathering The Storm: What To Expect

We do not know when markets will stabilise, but we are of the opinion that we are near the bottom of the current market downturn as inflation in the US is expected to “roll over” from the highs of 8.6% as the housing market softens and higher interest rates dampen consumer spending. Locally, higher petrol prices and loadshedding have severely dented consumer sentiment which will take some time to recover. We do know that the global and local consumer is surprisingly resilient, and we have seen many examples of people wanting to get back to normal after having to endure a lengthy period of lockdown restrictions.

We are comforted by the commitment from global central bankers to only raise interest rates as much as necessary (although a policy mistake remains a possibility) to rein in inflation and stabilise prices and while a recession in the US is likely, it is as likely to be shallow and short. With current asset prices accounting for this probability and valuations of most markets back below long-term averages, it is likely that the second half of the year will be better than the first. Volatility, however, will remain high until the effects of high inflation have passed and there is some resolution to the war in Ukraine.

We fully understand that in times like these, volatility and performance can be worrisome for members, but we would like to remind members that it remains of utmost importance to focus on longer-term return prospects and investment strategies, as short-term volatility and any reaction thereto could easily result in incorrect investment decisions. The highest likelihood of achieving one’s investment objective and goals is still to remain invested over time and participate in an upward trending market. It is all about the time in the market and not timing the market that makes all the difference.

Lastly, despite recent market volatility and uncertainty, the NFMW’s performance and track record over time, backed by its futuristic investment strategy, has demonstrated that it is well positioned to weather the storm and will continue to deliver superior risk-adjusted returns to its members.

Regards,

Mr Leslie Ndawana

Principal Executive Officer.

Cookie Notice

Cookie Notice Cookie settings

Cookie settings