Dear valued NFMW member,

As we step into the second half of the year, we are excited to share the Fund’s 2025 theme, one that speaks directly to you, our members. It reflects what matters most: delivering real value, supporting your personal and financial growth, and helping you prepare for a more secure future.

Empower. Evolve. Excel.

This theme was developed as part of the Fund’s long-term strategy and is rooted in our role in supporting you, your loved ones, and the communities around you, not only in retirement, but throughout life’s journey. We know your needs are evolving. That is why we are committed to adapting, improving, and innovating in ways that make a real, lasting difference.

Here is what this theme means for you:

Empower: Helping you make informed decisions and take control of your financial future

We want you to feel confident, informed, and supported, every step of the way. Empowerment means giving you access to the tools, knowledge, and guidance you need to make decisions with clarity and peace of mind. When you are empowered, you are better equipped to take charge of your goals and plan the life you envision.

Evolve: Growing with you in a world that’s constantly changing

Life is not static, and neither are your financial needs. Whether it is adjusting to new circumstances or embracing new opportunities, we are evolving to serve you better: through smarter systems, clearer communication, and member-focused services designed to keep up with the times.

Excel: Delivering service and benefits that exceed expectations

Excellence is our standard. From managing your retirement savings and risk benefits to supporting you through every interaction, we are committed to delivering real value, measurable performance, and service you can rely on.

This theme reflects our purpose: to make a meaningful impact in your life, today, tomorrow, and beyond. It guides how we serve you and how we continue to improve to meet your changing needs.

We are committed to empowering you, evolving with your needs, and delivering excellence in everything we do.

Warm regards,

Dr Leslie Ndawana

Principal Executive Officer

National Fund for Municipal Workers (NFMW)

AN OVERALL REDUCTION IN RISK COVER COSTS EFFECTIVE 1 JULY 2025

GOOD NEWS: You now pay less for the same risk cover!

As part of our ongoing commitment to delivering value to you as a member, the Fund recently completed its annual risk benefit review, and we are excited to share some good news.

Following a thorough assessment and favorable claims experience, we can confirm a reduction in the overall cost of risk (death and disability) cover across all categories, with no reduction in your benefits. You will continue to receive the same level of death and disability cover, while paying less, allowing more of your contributions to grow your retirement savings.

In addition, the funeral cover cost remains unchanged, and you and your qualifying dependants will continue to receive the same level of cover.

New reduced risk cover costs (Effective 1 July 2025)

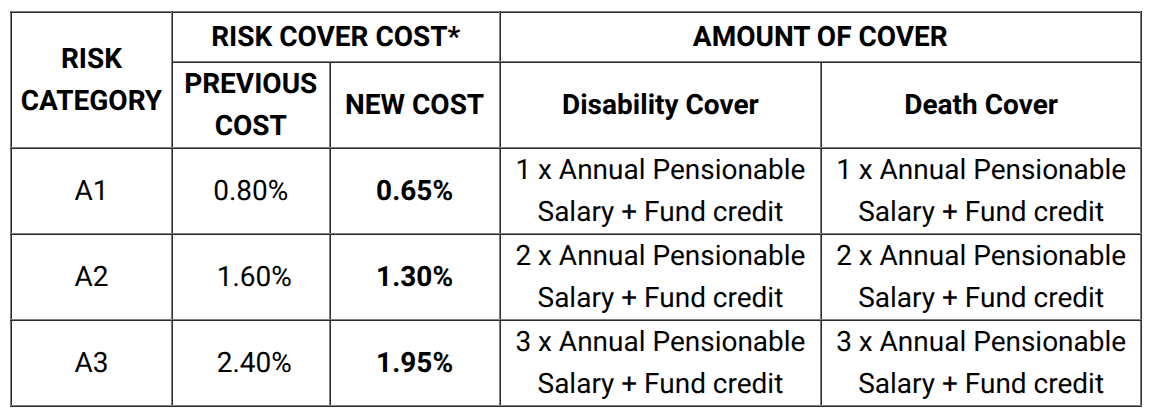

CATEGORY A (2% FUND)

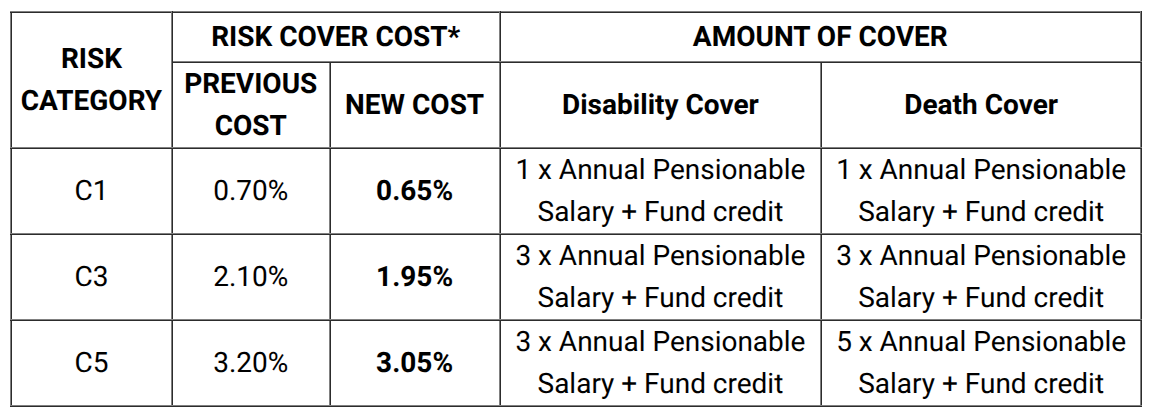

CATEGORY C (MAIN FUND)

*The risk cover cost is calculated as a percentage of pensionable salary and deducted from the employer’s contribution.

Members have the option to elect no risk cover in the Fund by selecting Category A0 and/or C0. In such cases, only the Fund credit will be payable in the event of death or disability.

NFMW MEMBER SURVEY - There's still time to provide us with your feedback!

A heartfelt thank you to everyone who has already taken the time to complete the member survey. We are overwhelmed by the number of responses received so far, and we’re listening.

If you have not had the chance to complete the survey yet, there’s still time! The closing date is 31 July 2025, and 60 exclusive hampers are up for grabs in celebration of our 60 000-membership milestone.

Your voice matters! Help us continue to evolve and improve.

LATEST INVESTMENT PORTFOLIO RETURNS

The Fund continues to focus on sound, long-term investment strategies. Here are the latest returns as at 30 June 2025:

| 3 month | 1 year | 3 years Ann | 5 years Ann | 10 years Ann | |

|---|---|---|---|---|---|

| Shari’ah Portfolio | 5,85% | 12,43% | 7,86% | 11,11% | 7,78% |

| Capital Protector | 2,51% | 10,24% | 9,26% | 7,43% | 7,60% |

| Stable Growth | 5,84% | 17,42% | 13,56% | 8,77% | 12,50% |

| Capital Growth | 7,17% | 18,04% | 15,15% | 12,84% | 9,28% |

| Aggressive Growth | 7,28% | 17,83% | 15,45% | 12,84% | 9,22% |

| CPI (inflation) | 0,59% | 2,82% | 4,41% | 5,10% | 4,81% |

Cookie Notice

Cookie Notice Cookie settings

Cookie settings